Our News

Is There Insurance Coverage If I Am Injured By or Riding In Uber or Lyft?

So, you decide to use Uber because it is easier or safer. Maybe you use Lyft for a ride. But what happens if your Uber or Lyft ride becomes an auto accident in Florida?

Uber, and its similarly operated competitor Lyft, allow smartphone users to digitally request rides from drivers who operate their own cars. Riders pay for the travel by credit card though the company’s app. Uber, Lyft, and other Transportation Network Companies (TNC) are revolutionizing the way people travel. But one thing hasn’t changed – people get seriously injured in car accidents all over the state of Florida. And when good folks get injured in an Uber or Lyft crash, they should talk to an attorney skilled in handling personal injury claims as soon as possible.

The absence of adequate insurance for drivers of an Uber or Lyft has generated controversy. The politicians and the public wanted to know who would be responsible when:

- An Uber or Lyft car injured another driver, motorcyclist, pedestrian, passenger, or bicyclist.

- A passenger in a Lyft or Uber car was injured as the result of the negligence of an uninsured or underinsured driver.

- A Lyft or Uber driver was injured by an uninsured driver.

- An Uber or Lyft car injured another driver, motorcyclist, pedestrian, passenger, or bicyclist while awaiting a ride.

These ride-sharing companies answered the question by promising that they had insurance coverage with one million dollar ($1,000,000) insurance policy limits. Uber and Lyft promised that if one of their “Partners” (read Drivers) injured another driver, pedestrian, or motorist while they were “on the clock,” then the Uber driver was covered for one million dollars ($1,000,000).

They also promised that if an Uber or Lyft customer was injured due to the negligence of an uninsured motorist, then Uber and Lyft have one million dollars ($1,000,000) in uninsured or underinsured motorist insurance coverage. In other words, the Uber or Lyft passenger with personal injuries as a result of an accident with someone who did not have car insurance, or not enough car insurance, would have one million dollars ($1,000,000) in insurance available to compensate them for injuries and damages.

But the question of PIP, or Personal Injury Protection, benefits has not been resolved. It is fairly certain that the Uber or Lyft driver’s personal automobile policy would deny coverage. Most auto policies exclude coverage when its insured driver is using the insured vehicle for a commercial purpose like driving for Uber or Lyft unless the insurance company knows about it in advance, which is commonly referred to as a livery exclusion. If the insurance company knows that the insured person or vehicle is driving for Lyft or Uber, then they can offer the correct policy of insurance and charge an appropriate premium.

On May 9, 2017, Governor Rick Scott signed into law House Bill 221, which will take effect July 1, 2017.

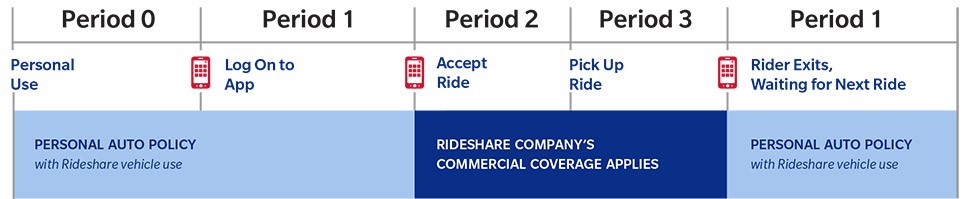

HB 221 sets various levels of insurance that either the ride-hailing company or driver’s personal policy must provide as drivers turn apps off and on, and transition from regular civilians to the ride job. That way, if a driver is involved in an accident in the period after logging into the app but before accepting a ride, the driver will have insurance coverage. Similarly, the driver will also have coverage during the period after the driver has dropped off a rider and before the next ride.

If you are interested in becoming, or already are, a driver for Uber or Lyft, please review your insurance coverage immediately. A new coverage, commonly called Rideshare, extends your personal auto insurance coverage through Periods 0 and 1 as shown below. Your full Rideshare coverage ends when you accept a ride request in the app (Period 2). When you drop off the passenger at their destination, Rideshare coverage once again applies while you are still logged into the app and until you accept your next ride request. Although this does reflect an increase in costs to the driver, it can be considerably cheaper than buying a commercial policy.

Our attorneys closely watch the law as it develops in the area of Uber or Lyft car injury crashes. If you were injured by an Uber or Lyft driver, seek appropriate emergency medical treatment, and then contact Hicks & Motto, P.A